multistate tax commission allocation and apportionment regulations

The employees residency status at the time of exercise. Multistate Tax Commission Model General Allocation and Apportionment Regulations Current as of 2017 6 is used in this state provided that intangible property utilized in marketing a good.

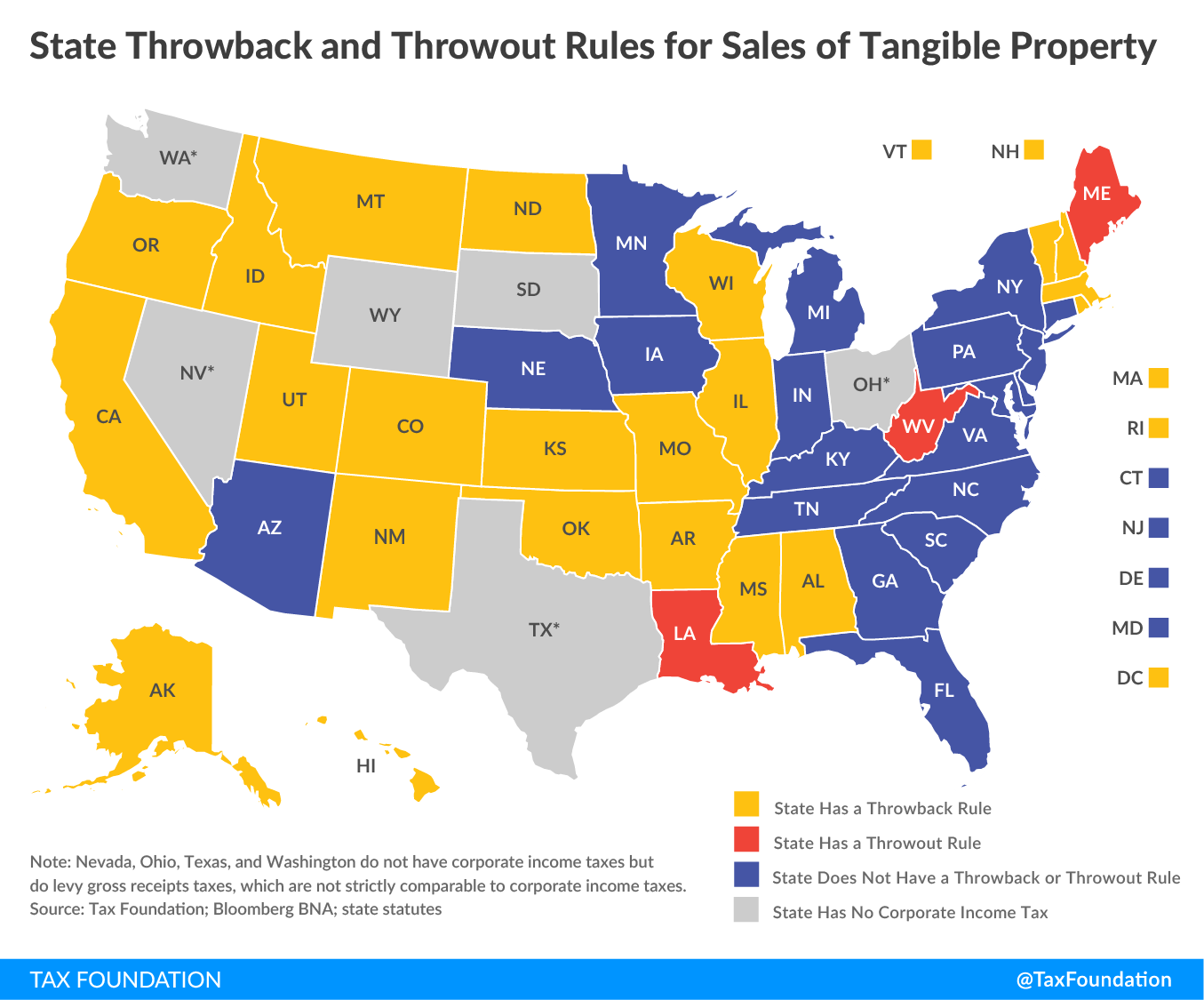

State Throwback Rules And Throwout Rules A Primer Tax Foundation

The Recommended Formula for the Apportionment and Allocation of Net Income of Financial Institutions was adopted November 17 1994.

. Trucking Companies July 11 1986. A Allocation of entire net income. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General.

Commission Allocation means fifty percent of the annual amount received under the. They are subject to adoption by each member. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment.

Multistate Tax Commission Allocation and Apportionment Regulations Adopted February 21 1973. On February 24 2017 the Multistate Tax Commissionadopted amendments to its Model General Allocation andApportionment Regulations. Commission Allocation means 50 percent of the annual amount received under the Master.

As revised through July 29 2010. New York Tax Law Section 1504 - Allocation. The general rule is that the person or trust that generates the GST tax pays such tax.

The Draft Amendments to the Commissions Model General Allocation and Apportionment Regulations were approved and commended to the Commission for adoption as a uniformity. The portion of entire net income of a taxpayer to be allocated within the. The proposed amendments to the model allocation and apportionment regulations under Compact Article IV Sections 1 and 17 were then ultimately approved by the full MTC at the.

Allocation is based on a multiyear method which is based on the time worked in Colorado versus the time worked outside of. Apportionment rules governing the payment of Generation Skipping Transfer GST taxes. The amendments to the model.

USA February 28 2017. For apportionment and allocation of net income for financial institu tions with the exceptions that the definition of financial institu tion in the appendix to the recommended formula is advisory. This rule is intended as an interpretive guideline in the application of Article VI of the Multistate Tax Compact section 32200 RSMo implemented by adopting the Multistate Tax.

Multistate Tax Commission With Helen Hecht Taxops

Kentucky Issues New Tax Regulations Part 2 Frost Brown Todd Full Service Law Firm

Draft Model Uniform Statute On Multistate Tax Commission

Why States Should Adopt The Mtc Model For Federal Partnership Audits

California Supreme Court Disallows Mtc Election To Change Apportionment Formula Deloitte Us

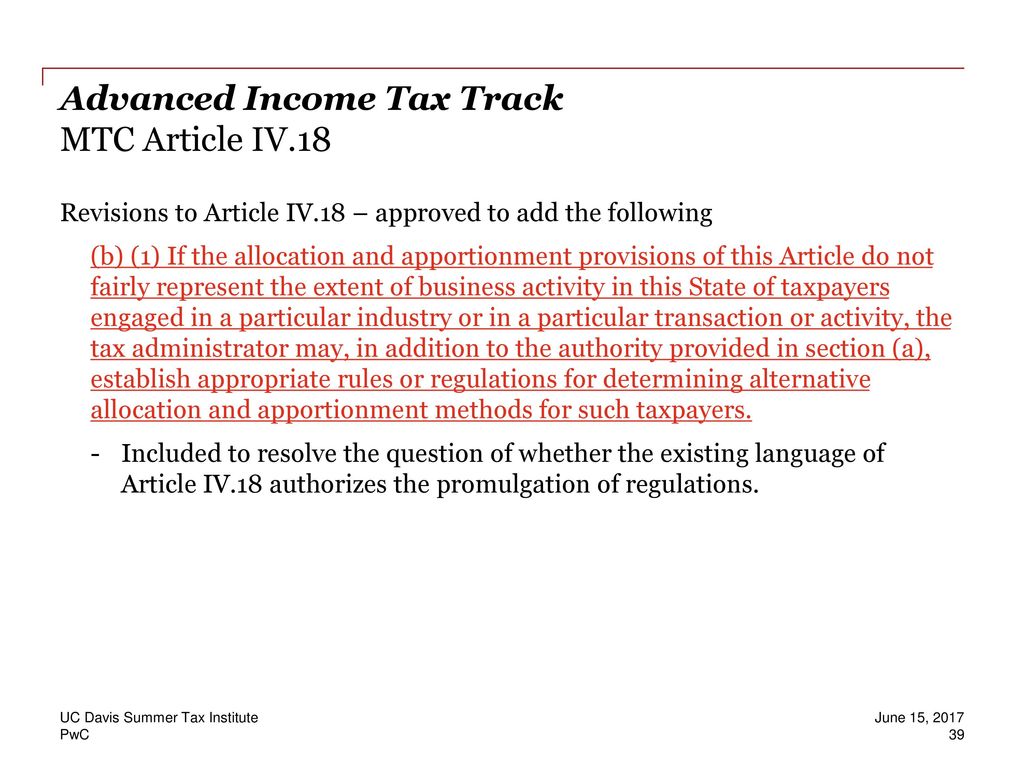

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Multistate Tax Commission Home

Draft Workgroup Memo Multistate Tax Commission

Unfair Apportionment Consider The Alternatives Tax Executive

Apportionment Using Market Based Sourcing Rules A State By State Review

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Pdf Formulary Apportionment And Group Taxation In The European Union Insights From The United States And Canada

Multi State Sales Apportionment For Income Tax Reporting Withum

Multistate Tax Commission Home

Pdf Designing A Combined Reporting Regime For A State Corporate Income Tax A Case Study Of Louisiana

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download